How to Buy a Rental Property in 2026 & What to Know Before You Invest

When you're searching for a strategy that will help you save for retirement and build your wealth, look no further than real estate investing. If you...

6 min read

Rent To Retirement : Jun 24, 2024 3:06:00 PM

Being a successful real estate investor requires you to regularly fine-tune your strategy to make sure you're implementing the best techniques available. In recent years, build-to-rent homes have become increasingly popular among investors because of their many advantages and comparably few drawbacks. This guide provides a comprehensive overview of the build-to-rent strategy and describes how your portfolio can benefit from it.

Build-to-rent (BTR real estate) is a relatively new real estate investing strategy where an investor builds a new home for the sole purpose of renting it out. Rental property investors prefer build-to-rent due to the low maintenance, high rents, and equity upside once the property is built. Built-to-rent properties can be single-family homes, townhomes, duplexes, or other multifamily properties.

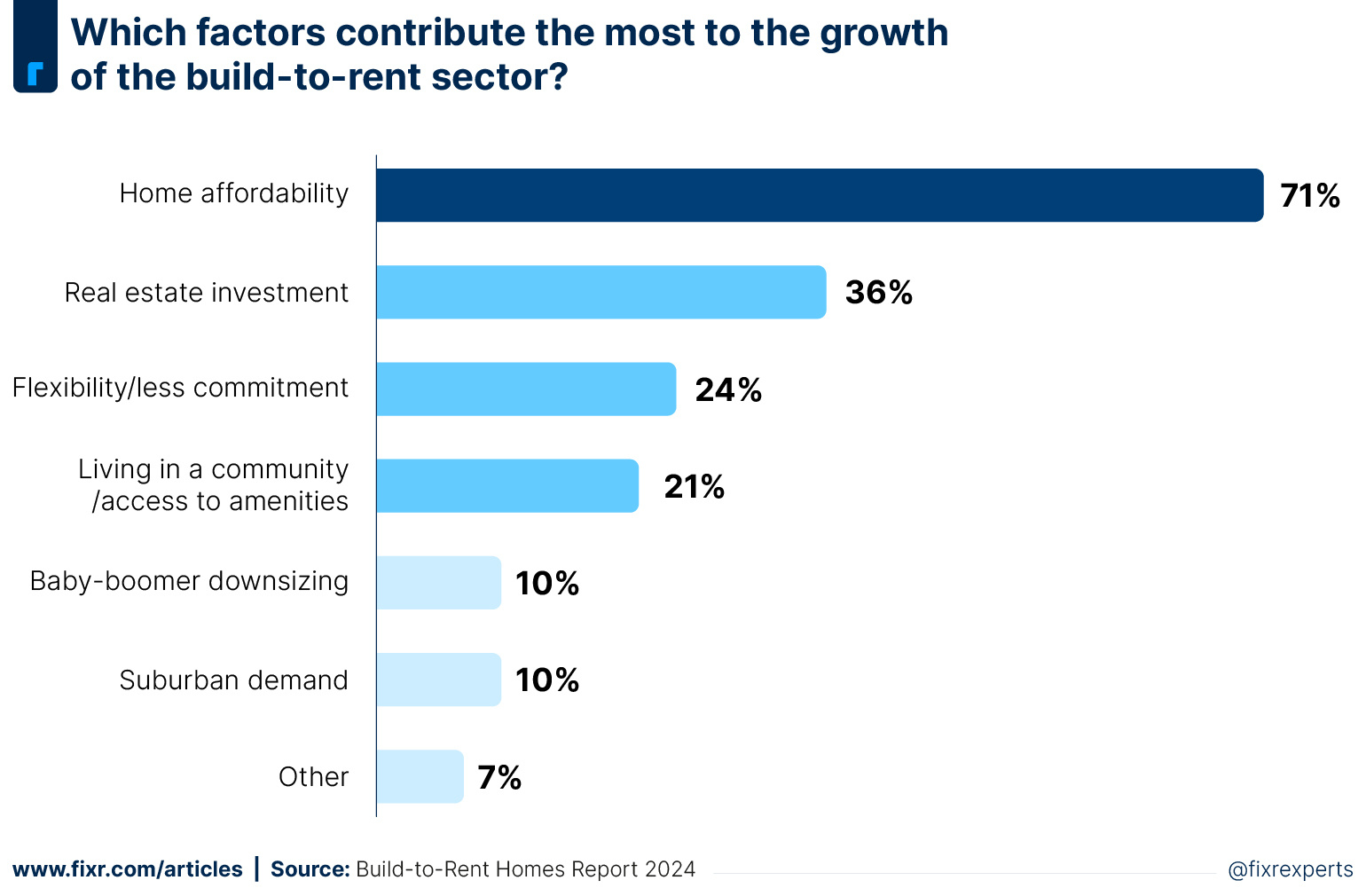

Build-to-rent has experienced a rapid rise in popularity recently because of the challenges investors are dealing with as part of the American housing market. The Federal Reserve has yet to drop interest rates, which means that the costs associated with buying a home are still too high for many buyers. While buyer demand remains high, most homeowners are staying put, which is why inventory levels are low.

When combined with high interest rates, new builds are more profitable and easier to invest in. Keep in mind that millennials are at the peak household formation age but can't purchase homes because of the lack of inventory and high prices. Many of the potential buyers who find themselves in this situation are deciding to become renters. What's better than renting an apartment while you're raising a family? Renting a home!

To understand how popular BTR properties have become, consider how much of them have been sold in recent years. Between September 2021 and September 2022, around 68,000 BTR homes were constructed, which makes up 6% of the properties built in the same period. Even though the percentage is still small, it's an increase of more than 40% from the same period in 2020-2021.

If you're interested in build-to-rent investing, there are five types of properties you can invest in. Understanding how these properties differ is necessary when you're searching for the right ones to buy.

Single-family homes are traditional residential properties that are often found in suburbs and neighborhoods. These homes usually have spacious lots and aren't connected to any other building. In most cases, one family or household occupies the home.

A small multifamily property offers the same benefits as single-family ones when you're renting them out. However, they come with anywhere from two to five units, which means that the earning potential may be higher in comparison to single-family homes.

Townhouses are single-family homes that have a shared wall and multiple floors. The primary distinction between a townhouse and a row home or duplex is that every unit has a different owner. These buildings can also be made with different designs.

Small-lot homes are single-family properties that are situated on a lot that's smaller than usual. A traditional single-family home often comes with a lot that's close to ten-thousand square feet in size. In comparison, small-lot homes are just a few thousand square feet.

Large multifamily properties are apartment buildings that consist of dozens or hundreds of individual units. By default, multifamily is almost always build-to-rent.

Looking for Build-to-Rent Turnkey Properties?

If you're considering buying a single-family home with the BTR strategy, the costs associated with this type of project can vary from market to market. However, single-family homes cost around $400,000 in the U.S. Prices are often higher near popular urban locations. You can find properties that range from a couple hundred thousand to $1 million.

BTR rentals come with a series of pros and cons. Before using the build-to-rent technique with your investment portfolio, weigh the advantages and disadvantages of this strategy.

From low maintenance requirements to the ability to charge high rents, the BTR strategy can be highly beneficial.

BTR properties come with very few maintenance requirements. These homes are newer buildings that shouldn't need much maintenance for several years.

Since the maintenance requirements are low, you can also keep your capital expenditures to a minimum. You'll benefit from higher cash flow, which you can use to purchase other properties or make improvements to your existing ones.

Since BTR communities come with new homes and modern appliances, investors can charge higher rents. Keep in mind that rent prices are increasing rapidly in many locations, which can lead to higher returns. In the U.S., the average rental price for a single-family home is around $2,400 per month.

It's not uncommon for BTR investors to walk into equity once their property is built! You can use this equity to refinance the property or minimize your portfolio's risk.

While there are many upsides to investing in build-to-rent investments, there are also a few drawbacks to consider. While BTR properties should be a boon to your investment portfolio, this strategy isn't right for everyone.

One issue associated with investing in BTR real estate involves the long build times. Single-family homes usually take around seven months to build, which means that you might need to wait before you can start marketing to tenants and charging rent.

You must also contend with oversaturation in some markets. While the BTR strategy can be highly effective, it should only be done in locations where housing inventory is otherwise scarce. Pay close attention to the housing market to ensure you make the right decision.

Build-to-rent homes are designed to be move-in ready with modern appliances, which means that you likely can't make valuable improvements to the property for at least several years. However, most single-family homes appreciate over time, which means that your investment should increase in value.

Even though there are a few potential downsides of build-to-rent, you can mitigate them and take full advantage of this strategy by working with a reputable and experienced BTR turnkey rental provider like Rent to Retirement. Our goal is to limit the risks so that investors can earn passive income and add valuable properties to their portfolios.

At RTR, we only sell properties that have already been built, which means that you won't need to contend with long build times. We also focus on areas that have strong investment potential. Our team does copious amounts of research on each location so that you don't have to!

Investing in build-to-rent real estate doesn't need to be difficult. Whether you work with a turnkey company like Rent to Retirement or construct your own home, the steps for this investment strategy are straightforward.

Before you begin the build-for-rent strategy, ask yourself if you want to perform the process yourself. This requires significantly more work than working with a BTR provider but will allow you to have maximum customization of the home.

You must perform ample market research before investing in any location. Make sure you choose a location that has a strong job market, simple construction codes, high property values, and proximity to good schools. Choosing the right market increases the chance that you'll gain interest from qualified tenants.

Find a builder you're confident can construct the home without experiencing delays or making mistakes. Search online to find reviews and testimonials that can help you learn about the builder you wish to hire.

The next step requires some math. Calculate how much money you can spend versus the amount you'll need to earn back from rental payments. Your goal should be to maintain positive cash flow. Let's say you buy a $300,000 home with $100 in monthly maintenance costs and $1,800 in mortgage payments. In this scenario, you'll need to earn at least $1,900 per month in rental income to cover your monthly expenditures.

Before you can close the transaction, you must apply for financing. While it's possible to buy a BTR property without a loan, funding this type of purchase is only possible if you have considerable cash reserves. A lender may only approve a mortgage loan if you have strong financials, a good credit score, and a high down payment.

Now it's time to wait. If you're building a home from scratch, expect this process to take at least seven months.

If you're interested in purchasing BTR properties, work with a turnkey provider who offers the homes you're looking for. Here at Rent to Retirement, we offer plenty of new construction homes that are move-in ready, which means that you can start charging rents soon after the purchase goes through. Once you buy the property, we can manage it for you, which allows you to earn passive income easily.

Schedule your free Rent to Retirement build-to-rent investing consultation here!

More investors are choosing build-to-rent as their next investment because of the plentiful upsides as well as the lack of housing inventory. While people initially transitioned to this investment strategy out of necessity, many investors are now deciding to focus on BTR properties because of how valuable they can be.

The majority of headaches and challenges that normally occur when investing in a rental property are mitigated by the home being new construction, which is why this is a great strategy for beginners. If you'd like to further explore BTR investing, book a call today to get started!

The build-to-rent business model involves building a home from scratch or purchasing a newly constructed one. Since these properties come with modern amenities and new materials, you can charge higher rents. Many investors choose to eventually refinance these properties and use the cash to invest in new ones.

BTR in real estate means build-to-rent, building the property from the ground up. You don't need to invest in old buildings and deal with existing tenants.

Building rentals allows you to benefit from minimal maintenance requirements, low capital expenditures, and high equity upside. If you pick the right location and accurately estimate your expenses, you can gain success by using this strategy.

When you're searching for a strategy that will help you save for retirement and build your wealth, look no further than real estate investing. If you...

Buying cash flow real estate is one of the tried-and-true ways to achieve financial freedom and build long-term wealth. In this guide, we’ll show you...

Do you want a low-maintenance rental property that commands higher rents and gives you more cash flow? A build-to-rent investment could be your...