Best States to Invest in Real Estate (2026)

Choosing the right market is a crucial first step toward buying a rental property, as there are all kinds of local economic factors impacting the...

4 min read

Rent To Retirement : May 22, 2024 2:55:00 PM

Indiana’s housing market is gaining attention as a potential goldmine for investors seeking passive income. With a remarkable 7.3% year-over-year increase in median home prices, Indiana is emerging as a lucrative destination for real estate investment.

In this article, we will delve into the driving forces behind Indiana's real estate potential, analyze market trends and investment metrics, navigate the housing market dynamics, unveil insider tips for real estate investors, and explore the future trajectory of Indiana's real estate landscape.

Indiana's real estate market presents a compelling case for investors, especially when compared to other top real estate markets across the United States. Let's delve into a comparative analysis of Indiana's cash flow, equity, and appreciation potential, shedding light on the impact of population growth and economic development on housing stability and growth.

Indiana's cash flow potential shows that it can offer attractive opportunities for investors. The rental market in Indiana has shown resilience, providing consistent cash flow for property owners. This stability is further bolstered by the state's steady economic growth and employment opportunities, which contribute to a reliable stream of rental income. Additionally, Indiana's affordable housing market ensures that investors can achieve favorable cash flow margins, making it an appealing choice for those seeking passive income through real estate investments.

Indiana's real estate market continues to demonstrate promising growth. The state's strategic location and robust economic development initiatives have fueled a steady increase in property values. This upward trajectory not only enhances the equity position for real estate investors but also signifies the potential for long-term wealth accumulation. Moreover, Indiana's proactive approach to infrastructure development and urban revitalization projects further amplifies the equity potential, positioning the state as a lucrative hub for real estate investment.

The state's proactive measures to attract new businesses and foster economic diversification have contributed to a positive trajectory in property appreciation. This, coupled with the steady influx of new residents, underscores Indiana's position as a real estate market poised for substantial appreciation. As a result, investors can capitalize on the opportunity to secure properties at favorable prices and benefit from the anticipated appreciation in the coming years.

With these things said, Indiana's real estate market offers a compelling blend of cash flow stability, equity growth, and appreciation potential, making it a standout choice for investors seeking to maximize their returns in the real estate sector. The state's proactive economic development initiatives and population growth dynamics further solidify its position as a hotspot for real estate investment, presenting a wealth of opportunities for astute investors.

Investing in Indiana's rental properties offers a myriad of benefits for individuals seeking to generate passive income and build long-term wealth through real estate. Let's navigate the housing market dynamics in Indiana, shedding light on the advantages of investing in rental properties and the nuances of property management that contribute to sustained financial growth.

Indiana's rental market presents an attractive opportunity for investors to secure a consistent stream of passive income. The state's affordable housing options and growing demand for rental properties create a conducive environment for investors to capitalize on rental income. Moreover, the stable cash flow from rental properties in Indiana allows investors to enjoy the benefits of passive income without day-to-day involvement in property management, offering a hassle-free avenue for wealth accumulation.

Navigating the intricacies of property management is essential for investors looking to maximize their returns in Indiana's real estate market. Partnering with reputable property management firms can streamline the process of tenant acquisition, lease management, and property maintenance, ensuring that investors can optimize their rental income while mitigating operational challenges. By leveraging professional property management services, investors can achieve a hands-off approach to real estate ownership, freeing up time to pursue additional investment opportunities and personal endeavors.

Investing in Indiana's rental properties not only provides a source of passive income but also positions investors to build long-term wealth through real estate appreciation and equity growth. The state's favorable market conditions, coupled with prudent property management strategies, create an environment where investors can benefit from sustained wealth accumulation over time. Furthermore, Indiana's proactive initiatives to bolster economic growth and infrastructure development bode well for long-term property appreciation, offering investors the prospect of substantial wealth creation through real estate investments.

Indiana's housing market dynamics present several opportunities for investors to capitalize on the benefits of rental properties, passive income generation, and long-term wealth accumulation. By understanding the nuances of property management and leveraging the state's conducive real estate environment, investors can position themselves for financial success and enduring wealth through strategic real estate investments.

Looking to invest in Indiana turnkey rentals?

Unveiling expert insights on real estate investment in Indiana is crucial for investors aiming to identify lucrative opportunities and navigate potential pitfalls in the housing market. By highlighting key strategies for maximizing returns and mitigating risks, investors can position themselves for success in Indiana's real estate landscape.

Conducting comprehensive market research and due diligence is paramount for real estate investors in Indiana. By analyzing market trends, property appreciation rates, and rental demand dynamics, investors can identify high-potential areas for investment. Moreover, understanding the economic drivers and growth projections in specific regions of Indiana enables investors to make informed decisions, aligning their investment strategies with areas poised for sustained growth and profitability.

Seeking guidance from experienced real estate professionals and local experts can provide invaluable insights for investors navigating Indiana's housing market. Collaborating with reputable real estate agents, property managers, and investment advisors can offer investors access to localized knowledge, market trends, and off-market opportunities. This strategic collaboration empowers investors to make well-informed decisions, capitalize on emerging trends, and leverage the expertise of industry professionals to optimize their real estate investment portfolios.

Mitigating risks in real estate investments requires a proactive approach to property management, financial planning, and risk assessment. Implementing robust risk mitigation strategies, such as thorough tenant screening processes, property insurance coverage, and contingency planning for market fluctuations, safeguards investors against potential challenges. Additionally, diversifying investment portfolios across different property types and geographic locations within Indiana can further mitigate risks and enhance the resilience of real estate investment ventures.

By embracing these insider tips and strategic approaches, real estate investors can position themselves for success in Indiana's housing market, harnessing the potential for lucrative opportunities while effectively managing and mitigating risks associated with real estate investments.

Indiana's real estate market stands as a compelling frontier for investors seeking to capitalize on the potential for passive income, equity growth, and long-term wealth accumulation. With a robust foundation supported by favorable cash flow dynamics, property appreciation potential, and strategic property management nuances, Indiana offers a wealth of opportunities for astute real estate investors.

By leveraging expert insights, conducting thorough market research, and implementing risk mitigation strategies, investors can position themselves for success in Indiana's housing market. As the state continues to evolve and present new avenues for real estate investment, proactive engagement with the market's evolving trends and opportunities will be pivotal for investors aiming to maximize their returns and secure enduring financial prosperity through strategic real estate investments in Indiana.

For more invaluable guidance and support on your turnkey real estate investment journey, schedule a consultation with our investing experts.

Choosing the right market is a crucial first step toward buying a rental property, as there are all kinds of local economic factors impacting the...

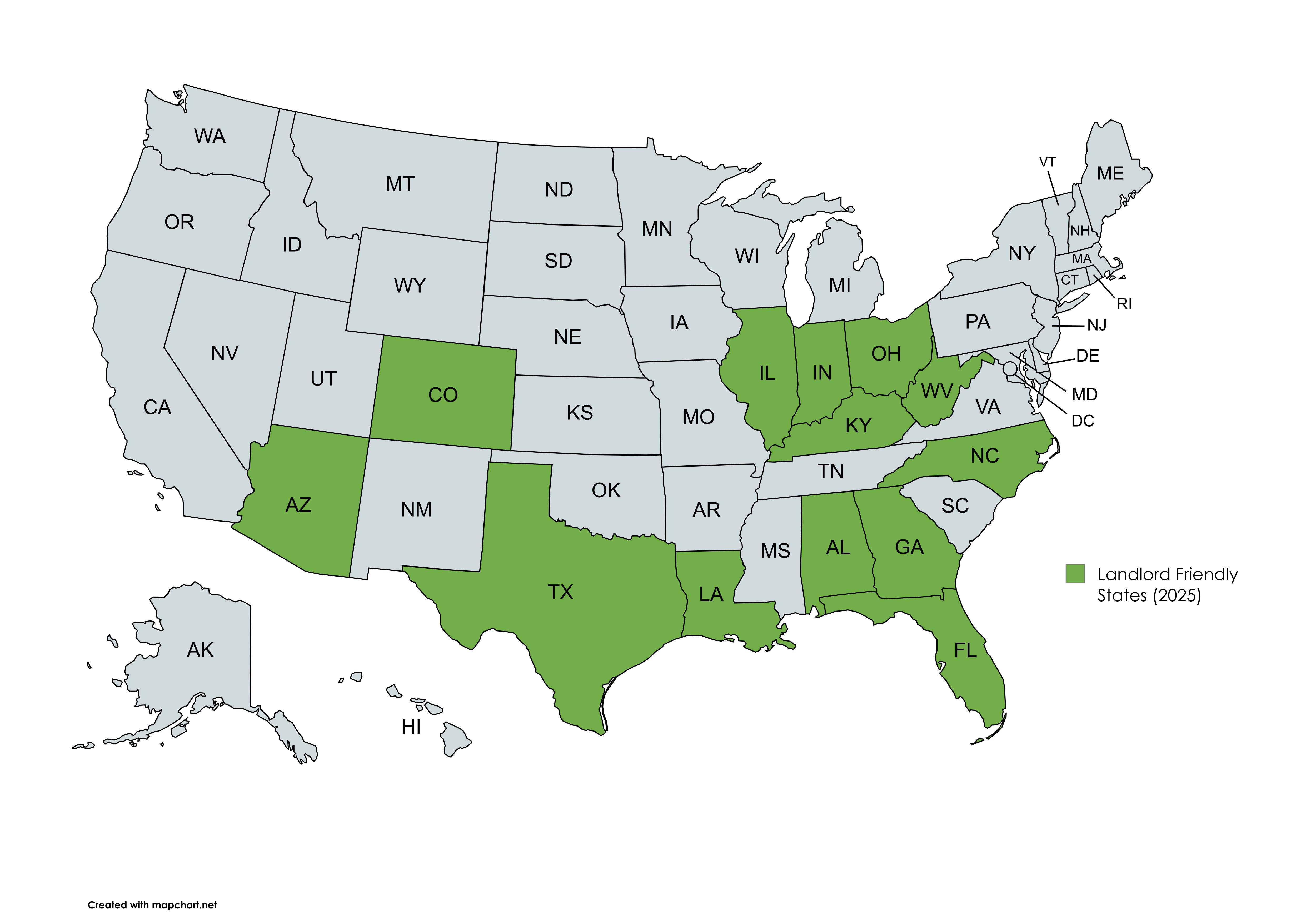

In real estate, where you invest is just as important as what you invest in, as landlord-tenant laws can impact the profitability and manageability...

The anticipation of mortgage rate predictions holds significant implications for both individuals and the broader real estate market. Understanding...