What a Landlord CANNOT Do (Florida)

Do you own or plan to buy real estate in Florida? The Sunshine State is one of thebest places to buy a rental property, but all investors andlandlords

7 min read

Rent To Retirement : Aug 1, 2024 1:02:00 PM

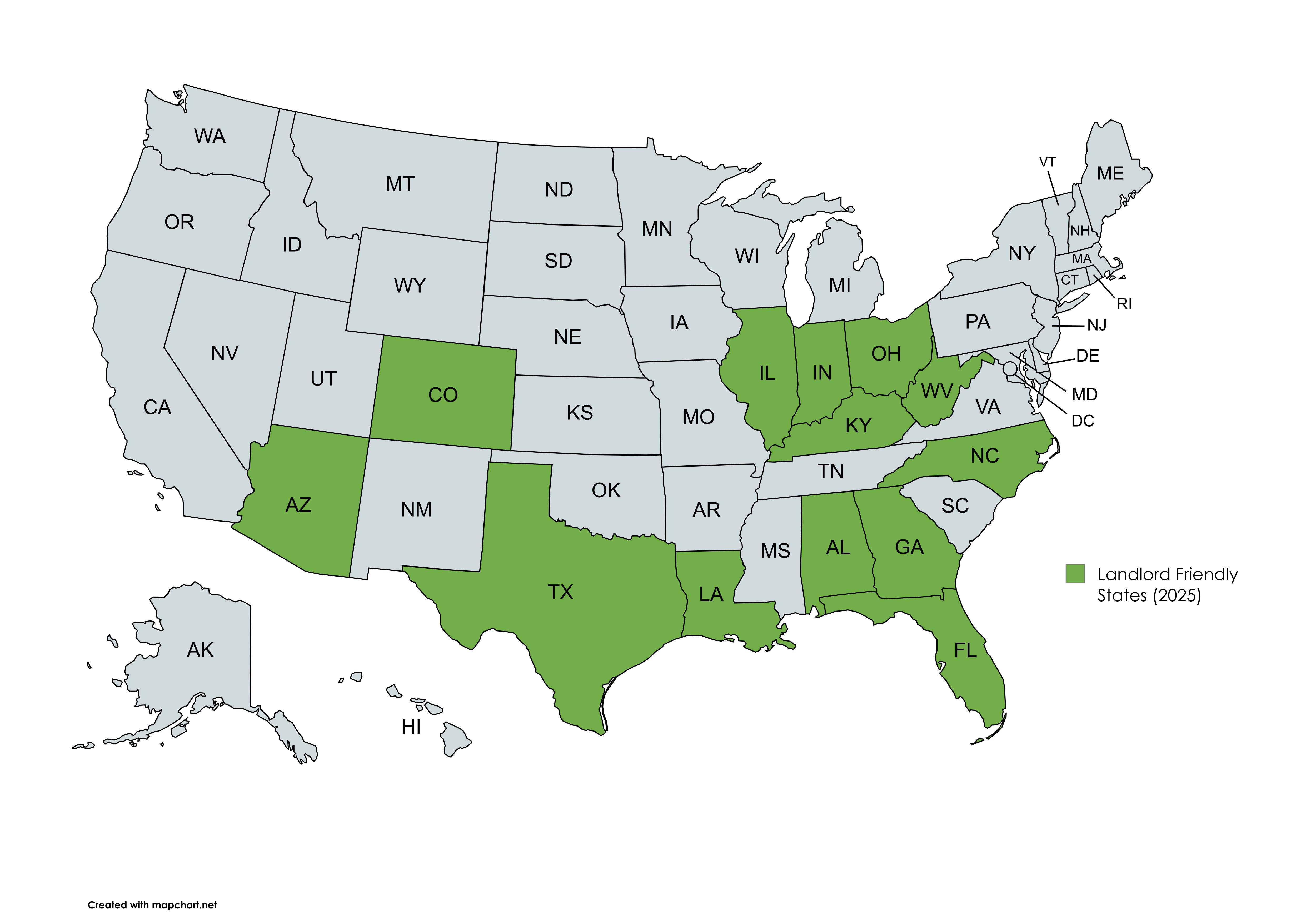

In real estate, where you invest is just as important as what you invest in, as landlord-tenant laws can impact the profitability and manageability of any property. In this quick guide, we’ll share 2026's most landlord-friendly states for investors so that you can choose the right market and make a profit!

A landlord-friendly state has laws, regulations, allowances, and economic factors that benefit the landlord, protect their rights, and give them greater control over their rental property. These factors not only affect your rent rates, expenses, and cash flow but also your ability to enter a unit and evict a bad tenant.

Because some laws are specific to certain towns and cities, it’s worth niching down to specific neighborhoods when looking for a market to invest in. Even the most landlord-friendly states have counties where regulations lean in favor of the tenant!

Property tax is a monthly expense that can quickly eat into your rental property cash flow. Look for states and counties with tax rates that fall below the national average.

Every investor deals with evictions at some point. A fast and straightforward eviction process can help you remove troublesome tenants and replace them with high-quality tenants with a shorter turnaround.

Insurance rates vary from one state or municipality to the next. If your property is in an area that is subject to crime or weather-related events, you can expect to pay higher insurance premiums.

On one hand, rent control laws incentivize tenants to stay in their current homes. However, these same laws dictate how and when a landlord can increase rent, which may affect your profitability.

Most states require landlords to give residents at least 24 hours’ notice before entering their units, but some states require an even longer notice. The shorter the notice requirement, the sooner you can inspect a unit or make repairs.

Some states require landlords to become registered and licensed before renting out their investment properties. This raises the barrier to entry and creates additional costs for the investor.

Crime rate is a significant economic factor affecting your ability to attract tenants and maintain your property. Generally, markets with low crime rates attract high-quality tenants and command higher rents.

A strong economy leads to higher wages and lower unemployment rates. As a landlord, this allows you to charge higher rents and source better tenants for your rental properties.

2,100 sq ft | 4 bed / 2 bath

Initial Investment

$55,000

Cash Flow

$385

Potential ROI

13%

2735 Brentwood Cv

Horn Lake, MS 38637

1,774 sq ft | 4 bed / 2 bath

Initial Investment

$65,000

Cash Flow

$591

Potential ROI

16%

Kimberly, AL 35091

%2001.jpg)

1,613 sq ft | 3 bed / 2 bath

Initial Investment

$67,000

Cash Flow

$216

Potential ROI

8%

Bessemer, AL 35022

If you want to maximize your cash flow and maintain control of your rental property, you should invest in a landlord-friendly state. Here are the states where laws and regulations are most favorable to landlords and investors:

With no rent control laws and the nation’s second-lowest property tax rates at just around 0.40%, Alabama is one of the best states for investing. Landlords have 60 days to return security deposits, as well as the ability to evict a tenant as soon as seven days after nonpayment or a lease violation.

Texas is one of the most landlord-friendly states due to its lack of rent control and favorable eviction laws. In fact, Texas rental property investors benefit from one of the fastest eviction timelines in the country. Landlords typically serve a three-day notice to vacate, unless the lease specifies a different timeline.

Is the Texas housing market the new real estate hotspot?

Update: Texas passed Senate Bill 1333, giving property owners more power to remove squatters from their properties. This also comes with increased penalties for trespassers.

Despite having the second-highest property tax rates in the country at 2.08%, Illinois has no rent, late fee, or security deposit limits. Landlords are also given up to 45 days to return security deposits after a tenant’s lease is up.

Like Texas, Ohio allows landlords to give nonpaying tenants three days’ notice to vacate the unit. There are also very few restrictions on rent increases, fees, and security deposit amounts, giving Ohio investment property owners a clear path to higher rents and revenue.

Florida is one of the fastest-growing and most landlord-friendly states, boasting below-average property tax rates and no limits on rent, security deposits, or late fees. Florida allows landlords 15 days to return security deposits (30 days if submitting itemized damage claims) and just three days’ notice to pay or quit (excluding weekends and legal holidays).

Check out our full write-up on the Florida housing market!

Update: Florida passed HB 621, where property owners can request law enforcement immediately to remove squatters if certain conditions are met (unlawfully entered and remained on property, directed to leave by owner, individual is not a current or former tenant in legal dispute).

Looking for High-ROI Investment Properties?

At just .75%, Indiana’s average property tax rates fall comfortably below the national average, allowing landlords to hang onto a little extra cash flow each month. The state also has no security deposit limits, and landlords have up to 45 days to return them to tenants.

Learn more about the Indiana housing market!

Update: Indiana passed SEA 157, expediting the sheriff removal process for squatters.

Georgia is one of the best states to be a landlord, as it has relatively low property taxes, no rent control or security deposit limits, and loose guidelines for eviction. Landlords decide how long nonpaying tenants have to pay their balance and have up to 45 days to return security deposits.

With the third-lowest property taxes in the nation and no rent control or deposit limits, Colorado gives its investors every opportunity to profit. Landlords can evict a tenant with a 10-day notice to pay or quit (updated from the previous three-day limit) and may hold security deposits for up to 60 days after leases end.

With no rent control in Arizona, landlords may set their own rent prices and increase them with a 30-day notice—assuming that this allowance is stated in the lease agreement. Arizona also has a short eviction timeline, allowing landlords to start the process with just a five-day notice to pay or quit.

Like many landlord-friendly states, North Carolina has relatively low property taxes and no rent control. What’s more, the state’s eviction laws allow landlords to issue unconditional quit notices to tenants who violate their leases.

Looking to invest in the most landlord-friendly states?

In Kentucky, median home prices are among the lowest in the country, making it an affordable place to invest. Landlords do not need a rental license, and the state has no limits on rent, security deposits, or late fees.

Louisiana has some of the lowest property taxes in the nation and very few restrictions on rent prices, rent increases, security deposits, and late fees. Landlord-tenant laws also allow five-day eviction notices for unpaid rents and lease violations.

With affordable home prices, low property taxes, and no license requirements enforced at the state level, West Virginia offers a low barrier to entry for investors. Landlords also have 60 days to return security deposits and are only required to issue a five-day notice before starting the eviction process.

While there are many states where laws work in favor of landlords, there are also states where they favor the tenant. If you’re a new investor or are wary of buying in a difficult market, you might want to avoid investing in these tenant-friendly states:

Investing in a landlord-friendly state makes it easier for your property to cash flow, and Rent to Retirement has turnkey properties available in some of the best landlord-friendly states. Let’s find your next investment property!

The best states to be a landlord include Alabama, Arizona, Colorado, Florida, Georgia, Illinois, Indiana, Louisiana, Kentucky, North Carolina, Ohio, Texas, and West Virginia. These states have laws and regulations that benefit investors and give them greater control over their rental properties.

While New York properties command high rents, the state is considered tenant-friendly due to its restrictive policies. With rent control laws, certain eviction protections, security deposit caps, and just 14 days to return deposits, New York is a tough market for new investors to navigate.

The least landlord-friendly states include California, Connecticut, Hawaii, Massachusetts, Minnesota, Nebraska, New Hampshire, New Jersey, New York, Oregon, Rhode Island, South Dakota, Vermont, and Washington. Investors in these states are often impacted by rent control, security deposit limits, drawn-out eviction processes, and other factors.

Do you own or plan to buy real estate in Florida? The Sunshine State is one of thebest places to buy a rental property, but all investors andlandlords

Choosing the right market is a crucial first step toward buying a rental property, as there are all kinds of local economic factors impacting the...

If you’re a Missouri investor or landlord, you should at least be familiar with state landlord-tenant laws in order to operate your rental properly...