Out-of-State Real Estate Investing in 2026 (Guide)

If you’re struggling to find affordable properties in your market or looking to diversify your portfolio, out-of-state real estate investing unlocks...

Choosing the right market is a crucial first step toward buying a rental property, as there are all kinds of local economic factors impacting the long-term outlook of your investment.

In 2026, different markets have started to shift. Some of the best states to invest in real estate are completely different than what they were last year. In fact, as we flip to a "buyer's market" in many landlord-friendly areas, investors may have more negotiating power, allowing you to get a better deal on your next investment property.

Rental property investing is the process of buying a property and renting it out (or selling it) for a profit. This profit may come in the form of monthly cash flow, “passive” income, tax savings, or property appreciation, depending on your investing strategy and long-term goals.

An investor will often renovate a rental property to increase its value and charge higher rents, but these projects require time and money. You can skip the legwork by investing in turnkey rentals instead. Rent to Retirement has recently renovated, move-in-ready rental properties for sale!

The best states to invest in real estate must meet multiple crucial criteria that help your investment grow.

Population growth indicates that a state or market is a desirable or affordable place to live. As more people migrate to a market, the demand for housing increases.

A strong economy produces high-quality tenants with stable incomes. Look for states and cities that have high job growth and employment rates.

Rental demand is determined by several factors, including population growth, cost of living, and housing affordability. When demand is high, landlords can charge higher rents and select tenants from a wider pool of applicants.

Vacancy can be devastating for an investor, especially if you’re relying on consistent rental income to pay your mortgage or bills. A higher occupancy rate widens your tenant pool and lowers your risk for extended vacancies.

Your long-term profitability depends on the trajectory of your rental market. Choose a market with a history of property appreciation, steady population growth, and future job opportunities.

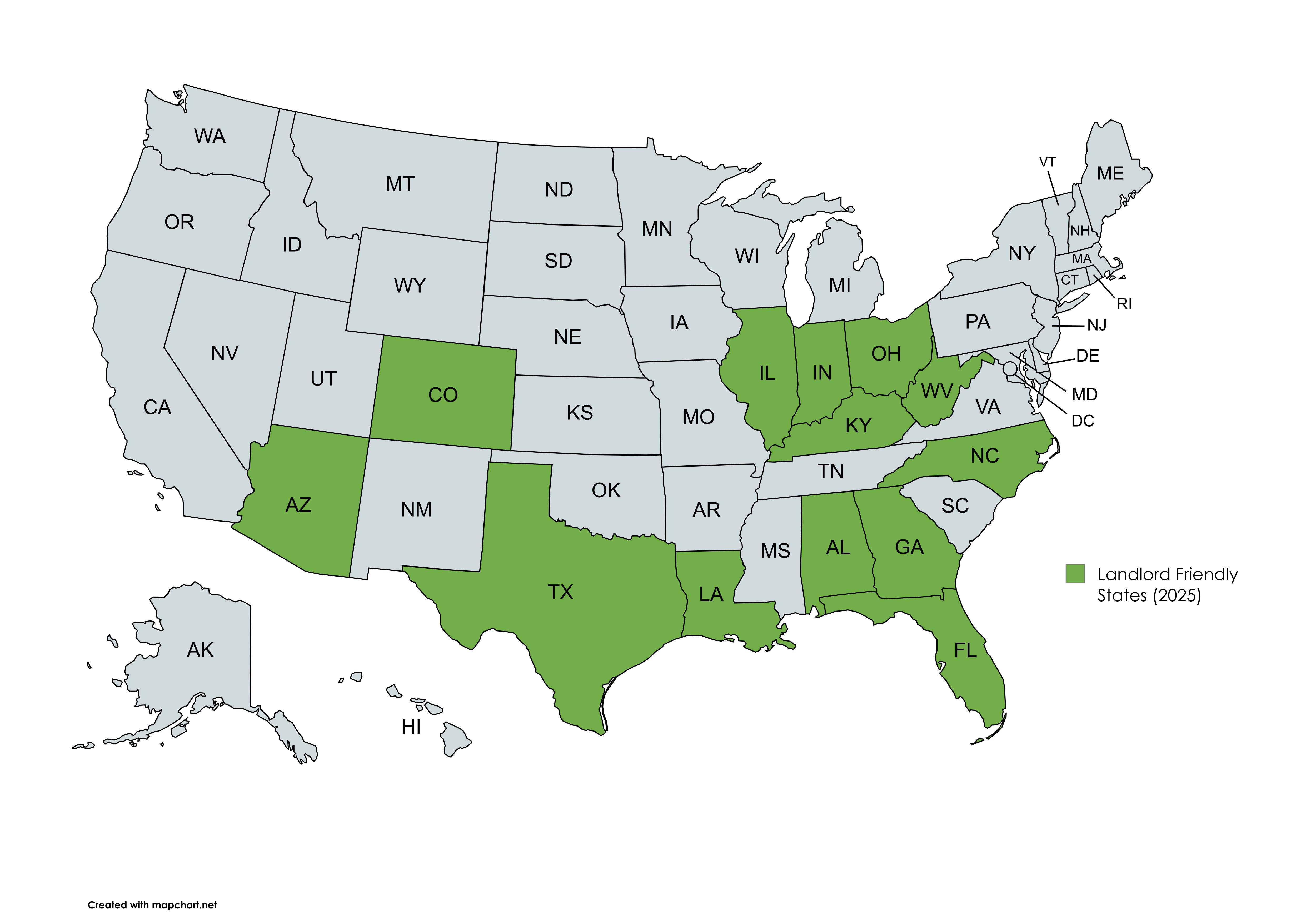

Landlord-tenant laws vary from state to state, impacting your ability to own and manage certain types of properties, raise rents, and evict tenants. Landlord-friendly states make it easier for investors to profit and achieve their investing goals, while tenant-friendly states are often more favorable to renters.

Taxes can quickly eat into your rental property’s cash flow. States with no state income tax, low property taxes, or certain tax incentives will help you keep operating expenses low and make you more profitable.

Choosing the right market is difficult, let alone finding a great rental property within that market. Fortunately, Rent to Retirement has turnkey properties in some of the best states to buy real estate!

With higher interest rates, higher home costs, and more inventory hitting the market, many southern and western states in the country have become strong buyer's markets. Texas, Florida, and the Gulf Coast in particular have seen some extreme cooling in homebuying demand since the peaks of 2021-2022. This creates an opportunity for investors, as many of these states have high populations, strong economies, and landlord-friendly laws, but may be experiencing short-term price weakness.

Source: https://www.realtor.com/research/reports/hottest-markets/

If you want to enjoy steady rental income, tax benefits, or property appreciation, choose a market that is friendly to investors. Here are 11 of the best states to buy rental property!

Despite its high property taxes, Texas is one of just nine states without income tax, allowing Texas rental property investors to hold on to more of their cash flow (if they live there). The Lone Star State also boasts a strong economy with steady population growth, a booming job market, and one of the highest renter-homeowner ratios in the nation.

Is the Texas housing market the new real estate hotspot?

Source: https://datacommons.org/

Texas continues to add employment.

Like Texas, Florida has no personal income tax, and its property tax rate of 0.80% falls comfortably below the national average. Buy-and-hold investors are rewarded with strong returns, as Florida housing prices have increased by a nation-high 67% since 2020 (as of 2024). What’s more, Florida is a landlord-friendly state with no limits on rent, security deposits, or late fees.

Interested in investing in Florida? Check out our Florida investment property guide (where, how, and what to buy)!

Source: https://datacommons.org/

Florida's median income continues to rise post-pandemic.

Did you know Rent to Retirement offers 5% down financing for new builds in Texas and Florida?

Alabama is one of the most affordable states to buy real estate, thanks to its below-average median home price and a 0.41% property tax rate that is second to only Hawaii. Housing laws are landlord-friendly, with no rent control and a speedy eviction process for nonpayment and lease violations.

Source: https://datacommons.org/

Alabama cities like Huntsville attract diverse talent for defense, technology, and aerospace fields.

With the seventh-lowest median home price in the nation, Missouri is yet another affordable state for buying rental properties. The state’s below-average effective property tax rate of 0.88% helps investors keep their expenses in check, while its housing laws are favorable to landlords.

Source: https://datacommons.org/

Missouri sees strong wage growth trajectory.

Browse turnkey rental properties for sale in these top markets!

Georgia is one of the fastest-growing states in the country, offering high rental demand and long-term gains for investors. While property taxes hover just below the national average, home appreciation has outpaced the nation over the last four years.

Source: https://www.redfin.com/state/Georgia/housing-market

Georgia still sees appreciation, even as many markets cool.

Kentucky has the fifth-lowest median home price in the United States, giving investors a low barrier to entry. Meanwhile, the state’s low cost of living has led to steady population growth and one of the nation’s strongest job markets. Kentucky is also landlord-friendly, with no limits on rent, security deposits, or late fees.

Source: https://datacommons.org/

Strong population growth in Kentucky, much of it fueled by affordable housing and low cost of living.

Much like Kentucky, Indiana boasts a strong economy and low cost of living. The state’s affordable home prices, low price-to-rent ratio, and low average property tax rate of 0.75% make it an appealing destination for investors.

Learn more about the Indiana housing market!

Source: https://datacommons.org/

Indiana sees employment continue to rise along with population.

South Carolina is one of the fastest-growing states in the country, and it’s easy to see why. The state offers a unique blend of affordable home prices and high appreciation.

Source: https://www.redfin.com/state/South-Carolina/housing-market

South Carolina seeing appreciation and transactions up YoY in 2025.

Buy your next hands-off rental property today!

Despite above-average home prices, Idaho’s growing population, high employment rates, and low crime rates allow landlords to benefit from high-quality tenants. Although home prices peaked in Idaho in 2022 after a sharp increase, prices are slowly back to rising as of mid-2025.

Source: https://datacommons.org/

Idaho crime rates continue to fall sharply.

Colorado has long been a hotspot for real estate investors, thanks to its high rent prices, rental demand, and the nation’s third-lowest property tax rate of 0.48%. Landlords are not bound to rent or security deposit limits and may start the eviction process following a three-day notice to pay or quit.

Source: https://datacommons.org/

Colorado sees impressive (and rising) median income.

Arizona boasts strong long-term and vacation rental markets, high job growth, and a low effective property tax rate of just 0.62%. Meanwhile, Arizona rental properties command above-average rent prices, and home prices have appreciated by 59.9% since 2020 (as of 2024).

Source: https://www.redfin.com/state/Arizona/housing-market

Arizona has seen a marginal YoY home price decline, with days on market rising. Signs of a buyer's market and opportunity for investors?

Before buying a rental property, carefully weigh the pros and cons of investing in that market. Typically, you will want to avoid areas that have low rental demand, tenant-friendly laws, poor economic or job market growth, low (or negative) population growth, and high crime rates.

While every state has good and bad rental markets, many landlords find the following states unfavorable:

Looking for the perfect property in a strong market? With turnkey real estate, you’ll be able to charge higher rents, keep your expenses low, and, most importantly, own an appreciating asset.

Rent to Retirement has turnkey properties for sale in some of the best states to invest in real estate. Let’s find your next investment property!

The best states to buy rental property include Texas, Florida, Alabama, Missouri, Georgia, Kentucky, Indiana, South Carolina, Idaho, Colorado, and Arizona. Many of these states have low home prices, high appreciation, and landlord-friendly housing laws.

Hawaii and California are the states with the highest average home values at $977,538 and $813,110, respectively. Despite tenant-friendly housing laws, these states are two of the most valuable housing markets in the United States. That being said, many landlords refuse to invest in both due to extremely high prices and the tenant-friendly laws.

Hawaii has the nation’s lowest effective property tax rate at 0.27%. Alabama and Colorado have the second and third-lowest property tax rates at 0.41% and 0.48%, respectively.

If you’re struggling to find affordable properties in your market or looking to diversify your portfolio, out-of-state real estate investing unlocks...

In real estate, where you invest is just as important as what you invest in, as landlord-tenant laws can impact the profitability and manageability...

Texas is one of the most popular areas to own real estate, with many investors flocking to large metro markets like San Antonio, Dallas, and Houston....